In today’s economic environment, a dollar of cash on-hand holds a lot more power than it did just a few short months ago. This reality is not lost on non-profit organizations who rely in large part on donations and fundraising to operate, especially those embarking on capital expenditure projects. While many projects are on temporary hold, many push forward with creative ways of filling out their capital stack. Most are familiar with relevant grant opportunities that exist, but often the key in filling that final gap can be found in a less well-known opportunity: tax credits.

It is an extremely common misconception that non-profit organizations and non-taxable entities like municipalities, quasi-government entities like EDAs, (etc.), cannot benefit from incentives like tax credits as for-profit developments can. While non-profits cannot recognize the tax credits themselves, they can be monetized with third party investors who can. In our previous post we discussed how powerful a financing resource Federal Historic Tax Credits can be, and BW&A has specialized for over two decades in guiding not-for-profit project sponsors through the process to qualify for, earn, and monetize these tax credits, in order to maximize both economic net benefit and efficiency from the process.

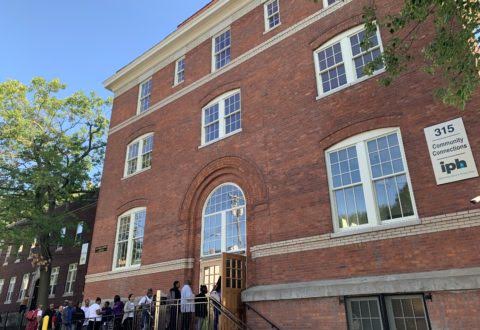

The rehabilitation of the historic Carnegie Library in Union, South Carolina is a fantastic story of such success. Rieta Drinkwine, Executive Director of the Union County Library System, which recently renovated its historic Carnegie Library (the first library sponsored by businessman and philanthropist Andrew Carnegie in the state of South Carolina back in 1905), had this to say about the benefit of using tax credit financing:

“The Union County Carnegie Library would not be the same without the use of historic tax credits, and some of the greatest aspects of our 2018 renovation and restoration project are the result of the tax credit funding. Using tax credits allowed our organization to increase accessibility, making the library the most accessible public facility in the county. Additionally, they enabled us to do a beautiful restoration of the original historic structure, which received a South Carolina Preservation Honor Award in 2019. Most significantly, tax credits facilitated the design of a vanguard partnership library facility that is now a community hub and the first facility of its kind in South Carolina. We are now able to have an ongoing, tremendous positive impact on our community with the renovated facility and expanded services and have experienced a 50% increase in facility usage.”

Rieta Drinkwine, Executive Director of the Union County Library

For this $3M project, a small project for tax credit standards, BW&A was able to help the Library recoup over 32% of its development budget from tax credit investor equity. This successful renovation has resulted in a completely modernized facility, providing new space in the Library dedicated towards honoring Union’s history, as well as new meeting spaces, study rooms, and partnership spaces for collaborating, allowing the library to further its role in representing a truly integral community hub. The lower level of the building now incorporates expanded children’s and teen’s spaces, featuring an early learning resource center in collaboration with Union County First Steps (a statewide public-private partnership to increase school readiness outcomes for children). The Library also provides office space for SC Works, and United Way of the Piedmont, a nonprofit, volunteer-driven organization dedicated to improving the quality of life for people in the surrounding counties.

For information about tax credits and how BW&A can help, please contact us today.